How Corporate Tax Cuts Can Actually Destroy Jobs

Here’s a short description of the methodology I used yesterday in explaining why allocating $3 billion of federal revenue to further corporate tax cuts (instead of other more effective stimulusmeasures) would actually destroy jobs (up to 46,000) on a net basis. It’s also available on the CAW site.

Corporate tax cuts have very little positive impact on employment, since they induce very little change in business capital investment spending. Historical evidence in Canada since 2000 (when the corporate tax rate, then 29.1%, began to be dramatically reduced) indicates that business investment has deteriorated since then – whether measured as a share of GDP, as a share of the existing capital stock, or as a share of corporate cash flow.

Indeed, business capital spending in recent years has fallen below realized business cash flow; companies have been accumulating cash and other liquid assets as a result. By the third quarter of 2010, the cash and short-term financial assets of non-financial businesses in Canada had reached $480 billion – almost a half-trillion dollars (source: Statistics Canada Balance Sheet data, CANSIM database). Since the advent of the recession two years earlier, businesses socked away an additional $83 billion in new cash. (This is in stark contrast to the behaviour of consumers and governments during this time, who incurred substantial new debt in order to finance expanded spending.) Further enhancing the cash flow of business, with no strings attached to incremental investment undertakings, will accomplish nothing other than enhancing that large stockpile of idle cash even further.

When governments allocate large sums of revenue to corporate tax cuts, those resources are no longer available to fund other priorities – like extending EI benefits for laid-off workers, investing in infrastructure or housing, or supporting public programs through transfer payments (like health care or education). All of those programs create far more jobs than corporate tax cuts. Therefore, shifting money from EI benefits (or infrastructure or public services) into corporate tax cuts destroys net jobs.

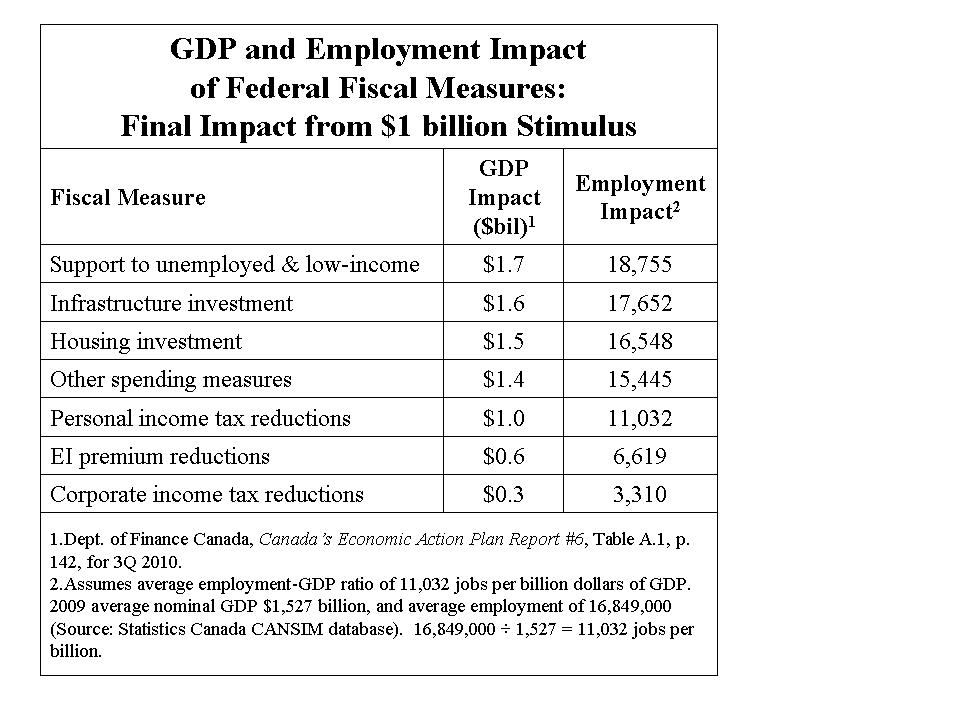

This is confirmed by the federal government’s own data. The following table summarizes Dept. of Finance estimates of the final impact on GDP of various government spending priorities.  (This table has appeared in several Dept. of Finance documents, most recently including Canada‘s Economic Action Plan Report #6, Table A.1.) Extending EI benefits has the biggest macroeconomic impact ($1.7 billion in total GDP from each $1 billion in benefits). This coefficient is greater than 1, reflecting the multiplied impact of government spending on incomes, spending, and job-creation. Cutting corporate taxes, on the other hand, has the weakest macroeconomic effect: just $300 million in new GDP for each $1 billion in tax cuts. In other words, of each $1 advanced in corporate tax savings, 70 cents leaks away before it even registers in Canada’s GDP.  On that basis, the proposed corporate income tax cuts (from 16.5% to 15%, costing $3 billion per year according to Dept. of Finance budget estimates) would generate less than $1 billion in new GDP.

The second column of the table then estimates the employment impact of each form of stimulus (based on $1 billion of stimulus for each initiative). The table utilizes the average employment content of GDP that was demonstrated in the Canadian economy in 2009 (Statistics Canada CANSIM database, most recent annual data available). In that year, each $1 billion of GDP supported an average of just over 11,000 jobs.

The employment impact of each $1 billion in stimulus spending therefore varies from a high of 18,755 jobs for support for the unemployed and low-income Canadians (which has the greatest positive impact on GDP of any of the stimulus measures), to a low of just 3,310 jobs (barely one-sixth as much) for corporate income tax cuts. The employment multiplier for corporate income tax cuts is so weak (in the Dept. of Finance estimations) because of the extensive leakages from stimulus injections that occur when government resources are refunded through tax cuts to businesses which are already hoarding cash. Unemployed and low-income Canadians, on the other hand, spend every dollar of their incremental incomes – and this in turn generates repeated cycles of spending and re-spending, ultimately adding up to much larger employment effects.

We may now estimate the employment effects of the proposed $3 billion in corporate income tax cuts. According to the Dept. of Finance multiplier coefficients, the tax cuts would generate just under $1 billion in new GDP, and just under 10,000 jobs (equal to $3 billion times 3,310 per billion). In contrast, if the same funds had been spent on extending EI benefits, GDP would expand by over $5 billion ($3 billion times 1.7), generating 56,000 jobs ($3 billion times 18,755 jobs per billion). The net effect of the tax cut, compared to the allocation of equivalent funds to more powerful stimulative measures, is the elimination of 46,000 jobs. (In economic parlance, the foregone jobs that would have been created if the money had been allocated to other initiatives is the “opportunity cost” of the corporate tax cuts.)

Other foregone spending initiatives also have powerful job-creating impacts, which will be missed as a result of allocating the available funds instead to corporate tax cuts. $3 billion in infrastructure investment would generate about 53,000 jobs, while $3 billion in housing investment would generate just under 50,000 jobs. By any measure then, allocating scarce resources to corporate tax reductions with such ineffective (even by the Dept. of Finance’s own estimation) impacts on GDP and employment, instead of to more powerful GDP- and employment-generating initiatives, will result in the substantial destruction of net employment – of as much as 46,000 positions in total.

Great work Jimbo,

we should gather together a few of these reports and put them together in special report or potentially a CCPA/CLC release.

Hi Jim Stanford,

I posted the following statement on CBC’s website after your own. Although the points you make are correct, we all know how decision-making is made between corporate donors (mostly invisible) and their government appointees (paid electoral publicity campaigns). The only way forward is for all of us to invest in the means of production which support us. In the process we develop ownership, informed decision-making, more efficient systems and cleaner environments.

Canada’s investment problem is the exclusive top-down nature of corporate ownership by 10% of the population receiving 90% of revenues. As long as all stakeholders (founders, workers, suppliers and consumers) in businesses, institutions and organisations at the bottom are not invested, then bosses and stock market at the top feel alienated from community, rank and file. Investment is a form of commitment to economy and community. Without relationship, the top 10% end up spending these tax saving surpluses outside Canada’s domestic economy. Examples of spending are high-ecological-footprint superficial past-times / exploitive material goods, cottages, foreign trips, investing elsewhere, drugs / alcohol (higher income brackets are the biggest addicts) etc. To form ‘community’ (Latin ‘com’ = ‘together’ + ‘munus’ = ‘gift or service’) we need to convene investment participation by all stakeholders in the ‘indigenous’ (Latin = ‘self-generating’) tradition

Thanks for the great analysis. But I checked the chart that appeared in the Economic Action Plan report, and there was an important note next to the stats about corporate tax cuts that you didn’t seem to address. It essentially says that although corporate tax cuts are shown to have the lowest GDP impact in a year-over-year basis, it has the largest impact over a longer period.

Now I’m not saying I believe that. But it looks like your argument is based on a shorter timeline than that of the Conservatives, and that does make a difference.

But I got to say, it’s great to see a debate going about what investments actually create jobs. Ignatieff recently highlighted investments in education as more effective than corporate tax cuts. There must be more to job creation than just tax cuts, tax cuts tax cuts, and it’s great that we’re talking about it.

I think the point Peter is that there is not really a compelling case to be made that we need to be adopting long term GDP augmenting policies right now. That is we do not need 100,000 jobs in seven years we need jobs in the nearer term. If CITs come at the cost of austerity we will get fewer jobs in the short term not more. And fewer jobs in the short term means lower aggregate demand over the medium and long term and thus lower levels of employment.

The ideal policy would be to stimulate direct job growth today and then in the medium term have the debate on altering the path of GDP growth via CIT cuts.

Let me put it another way. One of the recognized limits to stimulus via spending on public infrastructure is that it takes too much time to roll-out to be effective when you need it even if in the medium to long term it will be beneficial to the trend rate of GDP growth. CIT cuts are an equally sluggish proposition.

I think that footnote was tacked on specifically to discourage the type of analysis that Jim has done. But the footnote (under Table A1.1) does not actually state anything about employment.

It claims that corporate tax cuts will increase capital investment and hence productive capacity. Even if that claim were true, it would not really support the current spin about “job creatorsâ€.

Is it possible to infer from the table that personal income tax cuts create three times as many jobs as corporate tax cuts? And does anyone know whether that was assuming an across-the-board reduction, an increase in personal exemptions, or something else?

Now you know why Harper wants to take apart Stats Canada 🙂