Income and geographic distribution of low-income renters in Toronto

In this second of a series of housing-related posts I analyze the income and geographic distribution of renter-occupied households in the City of Toronto. My first post focussed on affordability and inequality trends by analyzing time series (2001-16) data for Ontario by household income quintiles. As a complement, this blog studies the income and geographic distribution of low-income and other renter households in Toronto based on census-tract (CT) data for 1996 and 2006. I expect to update and expand on this analysis after 2016 data is released later this year. This Toronto-specific analysis confirms the earlier provincial-level findings with respect to the broader structure and dynamics of the rental market. Based on this more disaggragate basis, I find that increased between-CT household income inequality is being driven by increases in inequality in owner households. The data shows significant income sorting by geography, so that higher (lower) income renters and owners tend to live in the same higher (lower) income CTs. Lower-income renters are concentrated in lower average income CTs, pay lower rents, but face a much higher rent burden. In subsequent posts I will update this analysis and discuss the policy implications and initiatives of these and other findings.

Census-tract rental data for Toronto

The Neighbourhood Change Research Partnership (NCRP) has been undertaking research on socio-spatial polarization trends in Canadian metropolitan areas for more than a decade. As part of this ongoing work, the NCRP purchased custom tabulations from Statistics Canada of census data at the CT level for a number of census metropolitan areas (CMA) and census years. The NCRP has kindly made the 1996 and 2006 tabulations available to me, including for the City of Toronto. The data includes over 520 CTs, which averaged about 1,725 and 1,865 households per CT in 1996 and 2006 (from 900,000 to 975,000 households in total), for an increase of just over 8% over the ten-year period. The number of renter households declined from 475,000 to 445,000 while owner household increased from 425,000 to 530,000 over the same period. Hence the proportion of renter households decreased from about 52% to 46% from 1996 to 2006.

The NCRP data tabulation is relatively detailed and includes average income for a a number of households per CT. However, the tabulation does not include quintile-specific income data. However, it does include disaggregate data for renters with a household income below 50% the median household income for the Toronto CMA (this measure is known as the Low Income Measure (LIM)). The number of LIM renter households was constant at around 200,000 over the period, which accounted for about 22% and 20% of all households and about 42% and 45% of all renters, respectively. For purposes of linking the current work to the quintile-based analysis of the first blog, I consider such LIM renters as approximating first quintile renters (in general, the LIM threshold is somewhat lower than the upper limit of the first quintile income group, but this is offset in this tabulation by renters not fully making up (70%) the first quintile or all households). Those “Other” renters with incomes above the LIM therefore approximate the renters in the second to fifth income quintiles. The number of Other renter households declined from 275,000 to 245,000 over the ten-yer period.

Renter Income Distribution

Table 1 includes average household income for renters and owners separately and for all households combined (in constant 2006 dollars) as well as the corresponding Gini coefficients. The table confirms that renter incomes are about half those of owners and that most average income gains over the 1996-2006 period accrued to owners. Between-CT income inequality increased over the period as well, as the corresponding Gini coefficient increased from 0.216 to 0.293. Table 1 shows that while between-CT owner income inequality increased (from 0.190 to 0.291), between-CT renter inequality decreased slightly (from 0.186 to 0.168), indicating that the overall between-CT increase in inequality was driven primarily by increases in between-CT owner inequality.

Figure 1 shows average household income for owners (green) and renters (blue) in each CT for 1996 and 2006, graphed against CT average household income (in constant 2006 dollars). The 1996 and 2006 trendlines for owners have very high R2, which indicates that there is a very strong correlation between owner and total income in each CT (this is expected at higher income CTs, given the generally very high proportion of owners in the CT). The shape and slope of the owner trendlines is very similar, suggesting that this correlation is relatively stable over time. The trendlines for renter households have relatively high R2, also suggesting a strong correlation. As a whole, Figure 1 shows that lower (higher) income renters tend to live in the same CTs as lower (higher) income owners. This shows that the well-known phenomenon of income sorting by geography by owner households is also applicable to renter households.

Renter Geographic Distribution

Figure 2 shows the percent of all renter (blue) and LIM renters (green) in each CT for 1996 and 2006, graphed against CT average household income, in constant 2006 dollars. For all renters and LIM renters the trendlines for both years show that the proportion of renter households decrease with average household income. As expected, the trendlines for LIM renters are below those of the the all renters, meaning that the former are more concentrated in lower-income CTs.

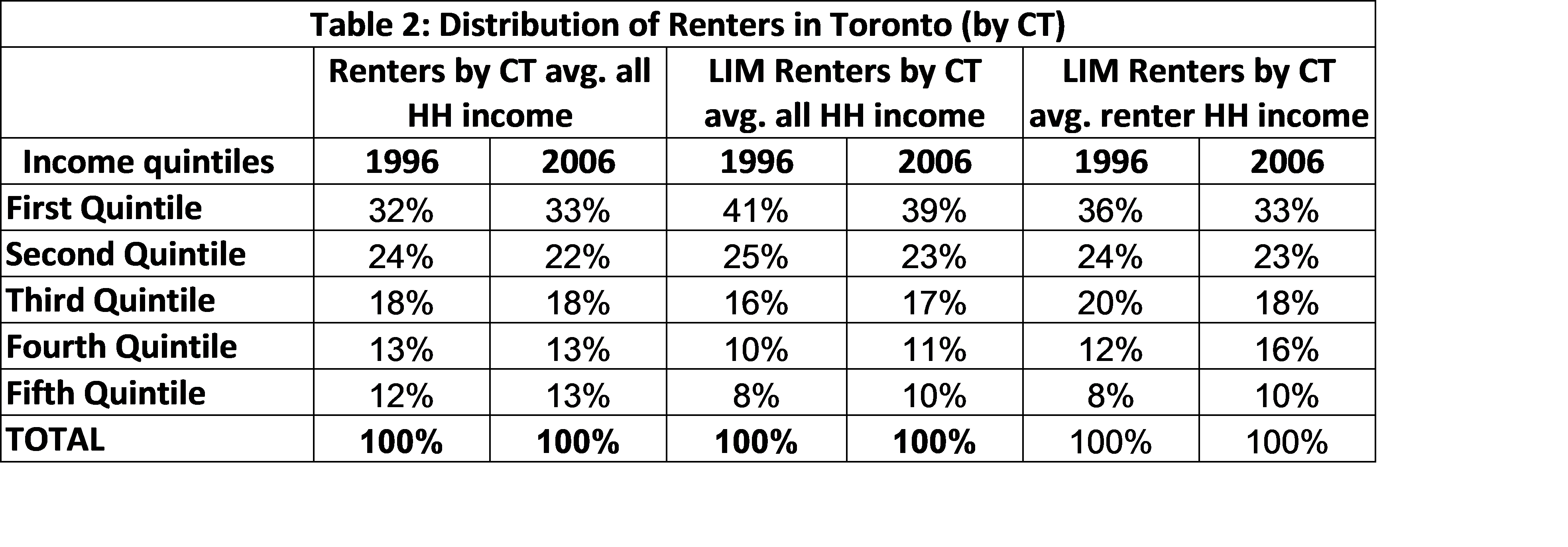

Table 2 shows the distribution of renters by CT income quintile for 1996 and 2006. An equal distribution would be 20% in each income quintile. However, Table 2 shows a considerable concentration in the lower quintile CTs, for example showing that 32% of all renters lived in the the first income quintile of CTs in 1996, increasing to 33% in 2006. However, the proportion of renters in the second quintile decreased from 24% to 22%, therefore lowering the concentration in that series of lower-income CTs. LIM Renters are even more heavily concentrated in the lower-income CTs, with 66% and 62% living on the first and second quintiles in 1996 and 2006, respectively. That decrease suggests lower concentration in lower-income CTs.

Table 3 provides the respective average and Gini coefficients for the the proportion of all and LIM renters and confirms that, overall, renters were indeed more unevenly distributed in 2006 compared to 1996 because the respective Gini coefficients increased from 0.275 to 0.304. As expected, the Gini for LIM renters declined somewhat from 1996 to 2006, indicating that they were less unevenly distributed.

Rent Expenditures and Rent Burden

Figure 3 shows the average rent paid by LIM renter households in each CT for 1996 and 2006, graphed against CT average household income (in constant 2006 dollars). In real terms, average LIM rents increased about 5% to about $775 per month. Figure 3 shows that rents generally increased with average CT income. Rents for Other renters (not shown) increased by about 1% to about $1,055 and thus tend to be about 40% higher than those for LIM renters. In my first post I noted that income cut-off data available for this analysis (such as quintile limits and LIM thresholds) does not adjust for household size and hence that there is an over-representation of smaller households in first quintile and LIM data. It is in this context that a significant proportion of the difference in rents paid by LIM versus Other renters may be explained by quantity differences (i.e. Other renters with an average of 2.45 persons/household, renting larger units than LIM renters with 1.90 an average of persons/household), with the residual rent difference being due to quality differences. I will explore this quantity/quality aspect of rent differences between LIM and Other renters in a subsequent blog.

Figure 4 presents LIM rents as a percent of household income for 1996 and 2006, graphed against CT average household income, in constant 2006 dollars. Other renters (not shown) paid a relatively steady average of about 19% of their income of rent for 1996 and 2006, suggesting these households geographically sort themselves by average CT income. On the other hand, LIM renters are generally struggling with rent, paying an average of about 57% of their income in 1996 and about 55% in 2006. This modest decrease is due to average real incomes increasing more (9%) than average rent (5%) from 1996 to 2006. This decrease is probably one of the main reasons that LIM renters become somewhat less concentrated in lower-income CTs over the period.

Concluding Thoughts

My first housing-related post presented provincial-level time-series data to conclude that over the 2001-2016 period rent expenditures for Ontario first quintile renter households increased faster than for other renters and exceeded income increases so that these households had to expend an increasing share of their income on rent. The current CT-level analysis for Toronto shows increased between-CT household income inequality is being driven by increases in inequality in owner households and significant income sorting by geography, so that higher (lower) income renters and owners tend to live in the same higher (lower) income CTs. Similarly, the proportion of LIM renters within CTs decreases as average renter incomes increase. The current work found that over the 1996-2006 period LIM rents also increased faster than for other renters, but that the average rent burden decreased slightly over the period because average incomes increased at a slightly faster rate. This slightly lower rent burden was one of the main reasons for slightly lower concentration of lower-income renters in low-income CTs. Statistics Canada released the income-related data from the 2016 Census last week, which suggests that the custom tabulation that corresponds to the current analysis may be available later this year. I look forward to being able to update this post with that data and discuss the policy implications and initiatives of these and other findings.