Stephen Harper’s Economic Record: Best in show?

According to the polls, Stephen Harper gets the highest score on handling the economy, though he only gets the nod from 38 per cent of Canadians.

As the incumbent, he’s got the advantage on all other candidates. What the others have done and might do is a topic for another blogpost.

This short summary of the Harper record on the economy may have even some Conservatives think twice before they elect the next Manager in Chief.

The Deficit, Part I: Passing the Buck

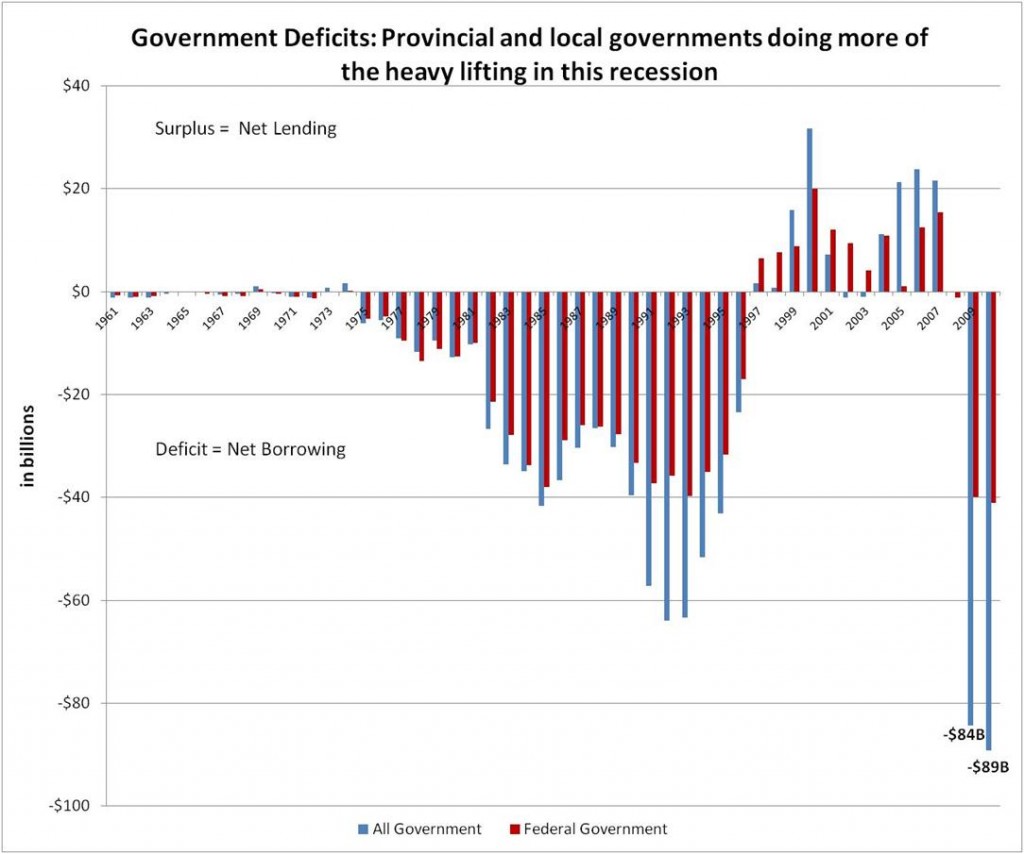

After the 1981-82 recession, the lion’s share of annual government deficit was borne by the federal government (well over 85% for most of that decade). After the 1990-91 recession, the feds carried roughly two-thirds of the load.

Today, the federal government is on the hook for the smallest share of post-recession government deficit on record. In 2009, 47% of all government deficit was federal; in 2010, it was 46%.

Most of the heavy lifting is now being done by junior levels of government – the provinces, territories and municipalities of Canada. They all face higher costs of borrowing. (The largest player, with the most diversified revenue streams, pays the lowest risk premium.)

As more borrowing gets done by lower levels of government, the carrying costs rise and Canadians pay more in tax than would otherwise be the case.  Cost-shifting makes it cheaper for the feds, but more expensive for you and me.

The Deficit, Part II: An avoidable hole

The Parliamentary Budget Officer warned that the Harper government didn’t have enough money to cover expenses even before the recession hit Canada.

Having inherited a $13.2 billion surplus from the Liberals, Harper cut the GST by two percentage points – wiping out $13 billion in potential revenues for this year, according to Finance. His corporate income tax cuts have reduced the public purse by $10.4 billion for 2011-12; and personal income tax cuts another $13.6 billion. Without these cuts we may have avoided a deficit altogether.

There’s more cuts to come, and Harper’s promises come with a hefty price tag. Splitting incomes ($2.5 billion); doubling contributions limits to Tax Free Savings Accounts ($6.6 billion); and more corporate tax cuts ($6 billion) will deepen Canada’s fiscal hole.  Continuing to cut revenues before the books are in balance is not prudent management. And that’s before you add in Harper’s new expenditure plans.

Where will the money come from to pay for the prisons, the fighter jets, the subsidies that propel the oil patch, the support for healthcare?

The Financial Market —Inherited good luck

The Harper team has rightfully highlighted the stability of our financial system in comparison to many other nations. But most of it had nothing to do with this government.

Canada’s monetary policy, which swiftly responded as the crisis unfolded, is independent of the government. Government does regulate the banking sector, though. Ours is more regulated than many other nations and Canadians like it that way. We have fewer mega-players, despite years of lobbying by banks seeking mergers.

We also have fewer over-extended mortgages. But we do have our share, thanks to Stephen Harper. In 2006 the floodgates were opened on zero-down, 40-year mortgages — the very thing that brought the global economic house of cards down in 2008. What had been a quiet practice since the 1990s became a bonanza for investors after Harper said yes to mortgage insurers in 2006: first Genworth, then AIG (remember AIG?), then CMHC.

When the credit crunch came, the federal government bought $69 billion of mortgages from the banks to keep the money moving. The banks didn’t sell the lowest-risk portfolios to us. Taxpayers are making money from the deal but that could change as interest rates rise or if another slowdown occurs.

Canadians didn’t avoid the mess; we just came late to the party, courtesy of Stephen Harper.

The Labour Market – Behind the bounce-back

Harper often repeats that we have “regained†all the jobs lost in the recession — but they are not the same jobs.  Almost half a million full-time jobs were lost in the first nine months, many with good wages, benefits and pensions.

The oft-cited rapid bounceback of the labour market is at least in part a function of the fact that this was the first recession since the Depression where the majority of the jobless had no income support. No income, no savings? You’ll grab any job that’s out there.

Most of the job creation since the market meltdown has been in healthcare, education and construction (largely public sector jobs — the part of the economy most likely to trim payroll in the coming months).

Private sector job creation has been strongest in temporary positions, part-time jobs and self-employment. The biggest loss to Canadians post-recession? Income security.

Emerging Challenges  –  Where’s the plan, Stan?

Three big issues will dog the next few Canadian governments: climate change, aging populations, and growing inequality.

On the first two, Harper has little to say. On the latter, the Conservatives are the only federal party whose proposals widen inequalities, rather than address them in a meaningful way.

Harper touts himself as the best manager of Canada’s still fragile recovery, but offers no real plan to address today’s pressing problems or prepare for tomorrow’s. Nothing but tax cuts and less interference in the market, that is.

Every election campaign is like a job interview. Voters listen and watch candidates as they show what they’ll bring to the job, with style and substance. Whether Harper, Ignatieff or Layton, remember to go back to the résumé before you make the hire.

GDP numbers out today seem like the high dollar is finally catching up to our manufacturing sector, at least this month. Lets see what happens but it was quite a bad monthly report.

There are so many other signs of the inequality and declining standards on average Canadians.

How can we as average Canadians say we have weathered the economic crisis better than most- our personal debt levels are at the highest point ever- in a very simple nutshell, we have just put this recession on our credit cards- both private and public.

Assets stood up better, due to policy that would never have crossed Harper and crews mind, direct intervention in the housing markets by previous liberal, NDP inspired housing policy kept us so far safe from a housing meltdown.

And again, Harper most likely would have liberated the big banks and financial sector further, he just was not in power long enough before the international financial crisis hit.

Our economy is approaching a point of running away, and it is going to take more intervention, not less to curtail the coming storm. So Canada needs more interventionist Govt policy not less.

two keys areas- employment loss and quality of employment – a massive transformation in the heartland of our value adding sectors. On Harper’s present course, Canada is becoming merely a Resource extraction economy. Such an economy will only divide this country further into the haves- and have nots- you cannot build a country on that economic foundation. Just look at the numbers, Manufacturing matters especially in Ont and QUEbec!! Which is organically linked to the new green knowledge economy- and this is the future, ask any future oriented and respected economist- what is the future of a high waged economy? green knowledge.

Second

Oil/dollar/ energy prices/ exports- Macro stuff is getting seriously out of hand. The dollar could seriously hit 110 any time soon, and I can say this, I bet Carny is doing many things behind the scenes trying to slow the dollar’s growth down. We know the US $ is falling, and after Bernake’s statement Wednesday of stay the course for the US Fed, the US$ is heading even lower as many expected a rate hike would be in the cards.

This could, given the forces at play push the Cdn dollar into a zone of irrationality for the economy for the following

We still cannot get the PPP to translate into meaningful cost reduction efficiency for import consumption/ very very sluggish. So our dollar is pricing our exports high and imports price sluggishness on the other end translates into murder for the economy.

Top all that off with a potential rate hike due to the hawks in the banking sector and their dementia on inflation (which fears are about fuel price creep and not actually capacity constraints, which inflation is supposed to be nailed to) and you have a real toxic mix for our dollar and the economy and ultimately jobs!

So what snake oil is Harper selling today?

pt

I guess I did miss one other thing- complete lack of vision for all of Canada.

There is no vision in Harper’s economic plan- nothing but the status quo of building a resource extraction economy, which means govt’s stay out of the way.

I remember on the first day of the Great Recession Harper being asked what he thought about it. The asshole smirked and said it’d be a great time for buying stocks.

Har-de-HAR!

I’d love to see that clip played endlessly on TV for the next two days . . . .

http://www2.canada.com/calgaryherald/news/story.html?id=2fa4902e-e111-436e-8756-e3b409e28a9b

Green jobs

Larry Kazdan, Calgary Herald

Published: Tuesday, April 26, 2011

Re: “Layton as PM would tank Canada’s economy,” Licia Corbella, Opinion, April 23.

More social equality and green jobs, as proposed by Jack Layton, would be good for business. But unsustainable Conservative policies, which rely overly on resource exports that drive up the Canadian dollar and hollow out Canadian manufacturing, will ultimately destroy our economy.

Larry Kazdan, Vancouver

© Calgary Herald 2011

Any change you could send me the source the cost of the tax cuts, in particular the person income tax cuts? Not finding numbers for that elsewhere. Would greatly appreciate.

Well we are unlikely going to be able to elect Jack…