Income Inequality & twitter

Armine Yalnizyan had a great twitter debate with Andrew Coyne on poverty and inequality that Trish Hennessey storified here:Â http://bit.ly/QwHGJB

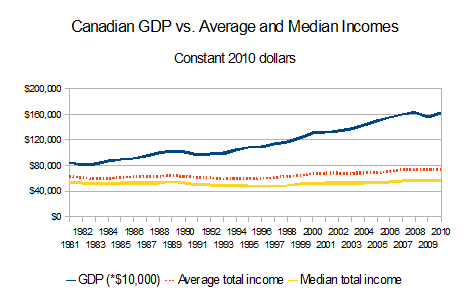

I think it bears repeating that GDP growth has far outpaced any growth in median and average incomes for Canadians, as you can see in the graph below. (2010 dollars, average and median income in $’s, GDP in $10,000 dollars.)

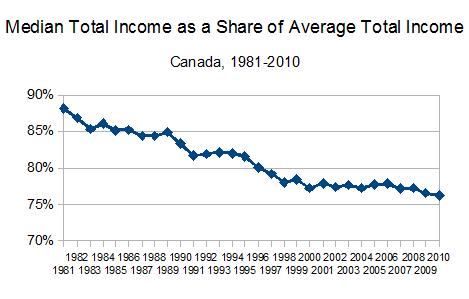

Also, average incomes are growing faster than median incomes. What does that mean? That means that incomes at the top of the distribution are pulling the average up, but the benefits of GDP growth aren’t reaching the majority of Canadian’s pocketbooks.

Given that high school drop rates have fallen over the past 20 years, and post-secondary certification rates have risen by 20 percentage points since 1990, to nearly 53% in 2011, one would expect that the increased education and skill of the Canadian workforce would merit an increased share of economic output. Instead what we see is stagnant median incomes and increasing income inequality.

I think Yalnizyan wins this one.

Sitting tantalizingly in a warehouse in Winnipeg are 2,000 boxes of information about one of the most fascinating social policy experiments in Canadian history.

http://www.thestar.com/opinion/editorialopinion/article/920145–goar-anti-poverty-success-airbrushed-out#article

The experiment began in 1974. It was designed to test the concept of a guaranteed annual income in a small, fairly typical, community. Dauphin, a rural municipality of 13,000 midway between Winnipeg and Regina, was chosen at the behest of former Manitoba premier Ed Schreyer.

The city’s low-income residents were lifted and kept out of poverty, using a negative income tax. (Canada Revenue Agency topped up their income if it fell below the poverty line.) They could use the money as they chose.

Canada: September 2011

snip snip: Trustees with the Vancouver School Board say they’re paying attention to the problems being raised by grade two and three teacher Carrie Gelson.

She created an open letter saying her students often came to school cold, hungry, and stressed.

http://www.news1130.com/news/local/article/281854–help-comes-in-for-teacher-with-hungry-and-cold-kids

http://www.facebook.com/#!/notes/cassia-kelly-kantrow/a-letter-from-a-teacher-at-seymour-elementary-located-in-the-dtes-let-me-know-if/10150383564943980

http://jo-online.vsb.bc.ca/div5/?p=1869

While I agree that these figures show a problem, there’s something about the whole debate as I’ve seen it over and over again that bugs me.

Basically, the figures typically cited by economists and media in general, and broadly accepted by progressive economists, show roughly stagnant median wages, or median household wages, or whatever. And so what progressive economists focus on is the injustice in a situation where the economy grows, productivity grows, but normal people don’t get anything out of it. Fine as far as it goes.

But in the real world, my overwhelming impression is that times are, for the median-ish person and lower, actually much tougher than they were thirty or forty years ago. Whatever we want to say about inflation-adjusted dollars, where our dollars actually stretch or fail to doesn’t get us as far. As far as I can tell, everyone I’ve ever met whose job situation has been relatively stable over time for a fair length of time is of the opinion that it’s tougher to get by nowadays than it was back when. OK, OK, anecdote/data I know, but seriously I feel there are lots of factors left out of the inflation figures they use to adjust, from tuition to government user fees to, if you’re talking “core” inflation, a long-run increase well above inflation of both housing and fuel costs. And this would seem consistent with the vastly increased average debt load in recent years.

So what’s the deal there? Is there any chance I’m ever going to see a study that analyzes people’s real situations in some depth and accounts for all the factors making people’s lives expensive that might not be included in measures of inflation? I’d really like to see that, both to get a better idea of the truth and because frankly, on a political level being able to say “Most people have actually lost ground, and here are the studies to show it” is way more incendiary than “Things have stayed about the same”.

Two factors that might account for some of Purple Library Guy observation:

I think these reports are measuring family income, during a time when the number of two income families has significantly increased. Families are working more just to keep up. Those who are working the same amount (like single parent families) fall behind.

Inflation would include things bought by rich people as well as poor and middle class people. Perhaps things bought be rich people are not inflating as fast as other things, driving down the average inflation so it does not reflect what most people actually pay.

Inflation cannot be ignored, or simply blame anemic wages. I cannot support higher wages, that would encourage higher prices. In the progressive point of view, ridiculously high prices, as long as wages increase faster. Inflationism from stagflation of 1970s, sadly shows clearly longer term wages do not have to increase. speculators get run wild with low interest rates, dollars borrowed trickle down, common women and men are left holding the bag of increasing standard of living.