Ontario’s Electricity Sector II: Political Economy Update

This is a third guest post by Edgardo Sepulveda, who is a Toronto-based expert in telecommunications and regulatory economics. Twitter: @E_R_Sepulveda

By Edgardo Sepulveda

In my previous post of January 29 I described how decisions by different Ontario governments gave rise to excess electricity generation with an inflated cost structure, leading to higher electricity prices and increased inequality. Since then, the Ontario Minister of Energy delivered a “mea culpa” speech on February 24 (the “Minister’s Speech”) that was followed on March 2 by a Liberal Government announcement to reduce electricity prices starting June (the “Liberal Plan”). The Liberal Plan is currently in the form of a press release and hence the Government will be required to introduce proposed legislation to give it legal effect. On February 27 the opposition NDP also announced its own election-style plan, including a reduction in prices (the “NDP Plan”) The opposition Conservative Party (“PC”) has now announced that it will release its electricity proposals as part of its overall election platform before the June 2018 provincial election. This post provides updated analysis of the issues I discussed previously, taking into account these recent announcements, which are summarized in Table 1.

Systemic issues leading to oversupply and inflated cost structure

The PC Government implemented Ontario’s competitive generation market in 2002 wishing to replace Government decision-making with market solutions. However, after the perceived failings of the competitive experiment, the Liberals changed tack in 2005, implementing the current Ministry-directed, contract-driven procurement approach. In the above-cited speech, the Minister described this model as one in which the “government arbitrarily mandates how much of our energy supply is derived from [different] sources.” Given this admission, much of the adversarial debate about the pros/cons of different generation technologies (nuclear vs. renewables vs. coal vs. conservation, etc.) can be seen as lobbying by different groups to “seek favour” from Governments to make arbitrary investment decisions. With respect to pricing, the Minister noted “We removed competition … and offered an attractive … rate” that led to “uncompetitive prices.” Finally, the Minister noted that “demand fell off a cliff” which also led to price increases. Regardless of this litany of admissions, the Liberal Plan (as explained below) does not include any measures to reduce oversupply or to eliminate any costs. In contrast, the NDP Plan identifies over-supply and inflated contracts as “long-term systemic issues” that it would address, achieving price decreases of up to 13% (in addition to short-term decreases).

Public Financing of Electricity Prices and the Election Cycle on Ontario

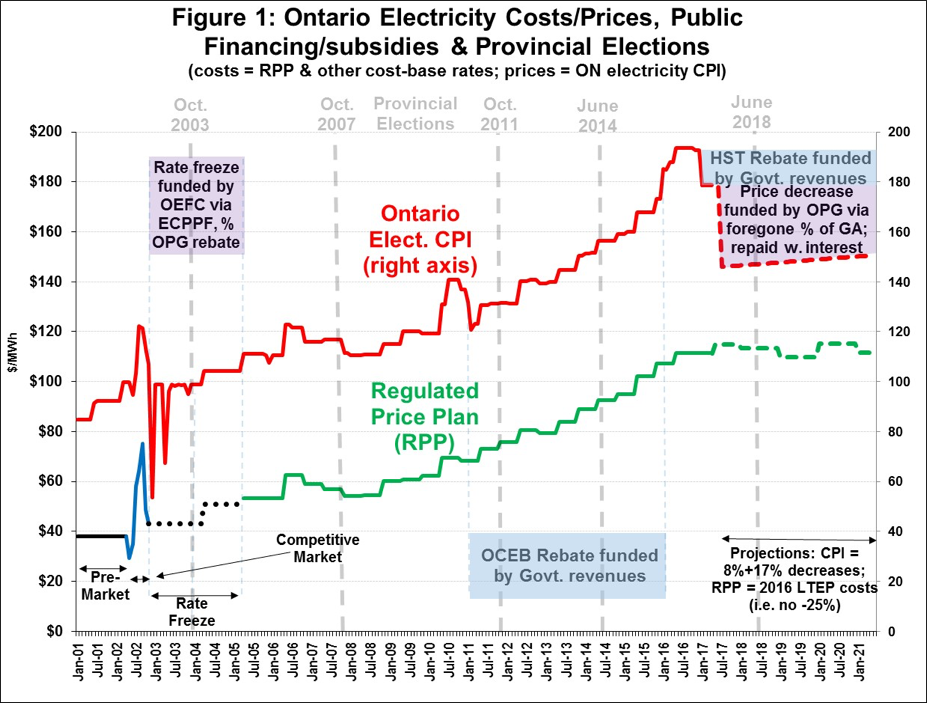

The other price-related elements of the Plans continue a longstanding Ontario political economy tradition of using Government revenues to reduce or smooth out electricity prices before elections. For example, both Plans include an HST rebate, which would result in foregone public revenues of about $1 billion/year. Figure 1, which tracks the Ontario electricity CPI and the Regulated Price Plan (“RPP” – the retail price for households and small businesses) from 2001. The differences (aside from scaling) between the RPP and CPI over the years can be explained by public financing or subsidies, starting with the PC Government’s “rate freeze” of November 2002, in advance of the October 2003 election. This was implemented by setting up the “Electricity Consumer Price Protection Fund” (“ECPPF”), which was managed by one of Ontario Hydro’s successor entities, the Ontario Electricity Financial Corporation (“OEFC”), and totalled about $2 billion over the November 2002-March 2004 period. Figure 1 also shows the Ontario Clean Energy Benefit (“OCEB”) rebate that started in January 2011, in anticipation of the October 2011 election, and lasted for five years, funded directly by provincial revenues (about $1 billion/year).

In addition to the HST rebate, the Liberal Plan also includes a current cost deferral mechanism whose objective is to reduce average consumer prices by a further 17%. While the specific nature of the administrative arrangements are subject to legislation, the plan “refinances” some current costs by deferring them to future years, when they will be required to be repaid with interest. The Liberal Plan appears to be asymmetric: it requires Ontario Power Generation (“OPG”), the publicly-owned generation entity, to bear all of the burden, while the private sector generators (“IPPs”) will not be affected (they will continue to receive 100% of their contracted revenues). The dollar amount in question could be in the order of $1.5 billion/year in the medium term. This forgone revenue corresponds to a portion of the Global Adjustment (“GA”) that would otherwise be paid to OPG by ratepayers and would accumulate in some form of a financial instrument that would have to be repaid by electricity ratepayers, with interest, over a thirty year period. Figure 1 highlights the price/cost wedge that the Liberal Plan would implement over the first four years (to 2021). I calculate the price paid by consumers based on my projection of the Ontario electricity CPI, while the current costs are presented as a projection of the RPP and are based on forecast unit costs from the Independent Electricity System Operator (“IESO) 2016 LTEP Outlook B (“Outlook B”). The cumulative 25% decrease included in the Liberal Plan would decrease prices back to mid-2013 levels, while the 30% decrease included in the NDP Plan (not shown in Figure 1) would reset prices to about mid-2011 levels.

The Liberal Plan as presented in Figure 1 looks relatively attractive because it only shows the cost deferral phase of the process (“short term gain”). Figure 2 shows one possible conceptualization of how the Liberal Plan could work over the stipulated 30-year period to 2046 by re-scaling the price and cost indices to be the same for 2016. Unit costs are based on Outlook B to 20135 and then I straight-line extrapolate to 2046. Prices decline by 17% in June 2017 by the deferral of costs as described above. Prices increase at 2% for four years (rate of inflation after which they increase to equal costs (at around 2028 in my example), after which the deferred costs have to be paid over the remaining period to 2046. Interest payments are included for all years in Figure 2. The Liberal Government has estimated such payments at about $25 billion; a number that has been disputed by a number of analysts that have suggested is likely to exceed $40 billion. The deferred costs and the interest payments are the “long term pain” that is being downplayed by the Liberal Government.

Impact on Households

I previously showed that rising electricity prices have increased inequality in Ontario as lower-income households have had to devote a growing proportion of their income to electricity expenditures. I extend this analysis based on updated (2015) household data from Statistics Canada. The Liberal Plan included some specifics (increasing the Ontario Electricity Support Program (“OESP”) benefits by 50%) and some options (possibly automatic qualification of recipients of social assistance), but did not provide specific dollar estimates. Surprisingly, the NDP Plan did not include low-income supports, but instead noted that these would be “part of upcoming announcements.”

For each household quintile, I forecast 2016-2021 “Base Case” (no -25%, no OESP) expenditures using the same CPI-based estimates as above, to which I apply OESP estimates only to the lowest quintile and a uniform 25% price decrease for all households. These two elements constitute the bulk of the Liberal Plan (the main exception being the rural assistance), but could also represent the 30% uniform price decrease included in the NDP Plan (the Liberal enhanced OESP could be used to benchmark the “mechanisms” to be announced by the NDP). I calculate the average OESP benefit by increasing the current average $35/household benefit by 50% and raising the OESP participation rate to 60% (the original Ontario Energy Board (OEB) estimate) by 2018.

Figure 3 shows that higher-income households have higher electricity expenditures and therefore would benefit more from uniform price reductions. For example, over the 2018-2021 period, each household in the highest 20% income group (quintile) would have savings of about $560/year, compared to $410/year for the middle income quintile and only about $235/year for lowest income quintile. Overall, for all households, the 25% reduction would be equivalent to about $2 billion/year over the same four year period. The savings would be correspondingly greater for the uniform 30% price decrease in the NDP Plan. This type of untargeted price decreases provide greater money amounts to higher-income groups. Do we really think that it is appropriate to give high-income families with an average income of $216,000/year an annual break of $560 in their electricity bills, while we give middle-income families a $410 decrease and low-income families only a $230 break? The enhanced OESP benefit would mean average savings of about $200/year for the lowest income households, so that the average total reduction is $435/year or comparable to the middle-quintile household, but still much lower than the highest quintile. Even after this combined decreases, electricity expenditures by the lowest-income households are still proportionately higher than those of the middle or highest-income households.

Other Issues and Concluding Thoughts

As set out in Table 1, the Liberal and NDP Plans include a number of other elements, including the NDP’s proposed return of Hydro One to full 100% public ownership and elimination of mandatory time-of-use pricing in the NDP Plan. The PC party will add to the mix when/if they decide to release their sector proposals. The Liberal Government has a legislative majority and hence the Liberal Plan will likely take practical effect in June 2017.

As such, it will no longer be just a plan, but an administrative and financial reality. Therefore, in a manner not dissimilar to their 20-year fixed price contracts policy, the Liberal Government is “hard-wiring” a long-term policy that future (including Liberal) Governments will find politically difficult and/or financially expensive to revise. In a technologically-dynamic sector such as electricity, which is expected to be the subject of substantial structural reform over the next three decades, it is irresponsible for this Liberal Government to commit to such arbitrary 30-year financial solutions that appear to be motivated by political survival rather than promoting the public interest.

What about the Green Party of Ontario’s Electricity Plan?

Keenan, I did look at the Green Party of Ontario (GPO) work on the hydro file. I also examined that of the PC Party. The PC Party has a series of hydro statements and policies, but as the PC Energy critic has inferred, these do not constitute a “plan.” As a noted in the post, the PC Party has now decided to release any such plan closer to the June 2018 election.

In the same manner, I reviewed and studied a series of GPO hydro statements and policies. However, I was not able to find a GPO “plan” – an approved document that shows how each of the policy elements fit together (sequencing, short vs. long term, etc.); an indication of how they would be implemented (mechanisms, programs, etc.); and what quantifiable impact (dollar or percentage terms) each element is likely to have on hydro prices or some other important electricity metric, either in the short or long term.