Ontario Electricity Sector VI – Meet the new boss…

The provincial election of June ended 15 years of Liberal electricity policy in Ontario. Anger over high electricity prices continued to be an election issue, contributing to the Liberal loss of power and official party status (reduced from 55 to 7 seats). The PCs have formed Government with 76 seats, while the NDP is official opposition with 40 seats, and the Green Party won their first seat.

The PC Government has moved quickly to act on some of their election promises and other unannounced initiatives, including on the electricity file, convening an exceptional summer session of the Legislature. The new Minister of Energy, Greg Rickford, cancelled 756 renewable energy contracts via Ministerial Directive in early July. Later in the month the Government rushed an omnibus Act through the Legislature (time-allocated debate, no Committee review, no public hearings, no opportunity for amendments) that changed the governance of Hydro One and canceled the White Pines wind power contract in Milford. Here I will first review the Government’s options with respect to the Liberal’s “Fair Hydro Plan” (FHP) before I discuss these cancellations.

Fair Hydro Plan

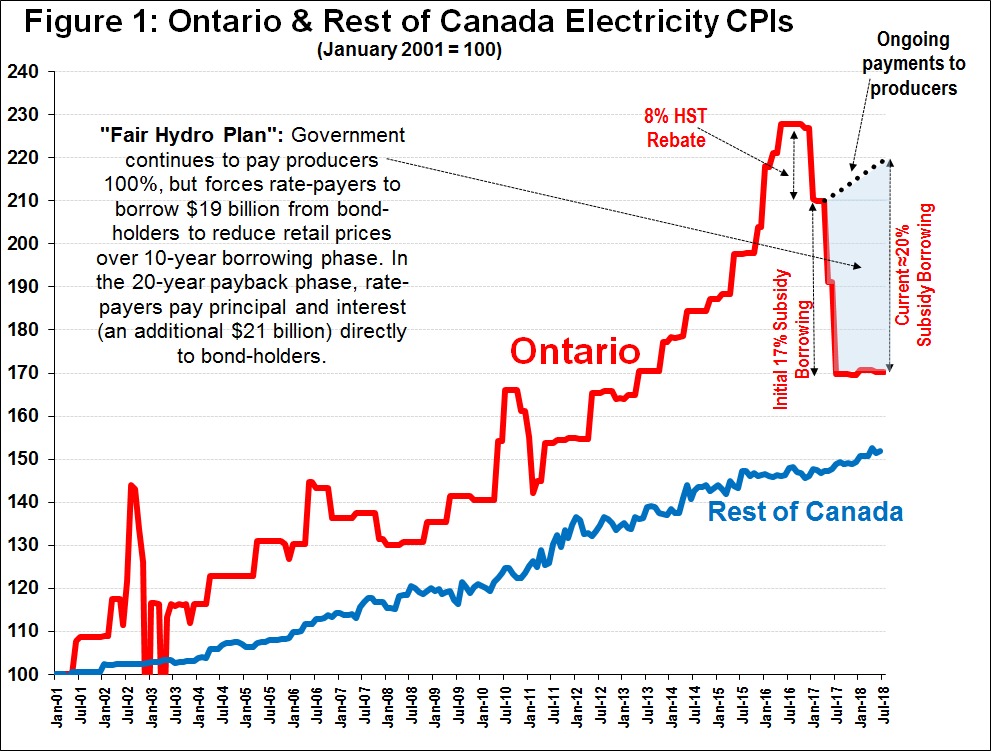

In 2017, the Liberal Government introduced the FHP that reduced electricity prices by 25%, consisting of 17% from the deferral of a portion of payments to power producers and 8% from the rebate of the provincial portion of the HST (financed from the tax base). Figure 1 shows how the FHP has impacted Ontario’s electricity CPI and how even after this reduction, Ontario’s CPI is higher than the average electricity CPI for the nine other provinces (“Rest of Canada”). The FHP’s initial 17% reduction was financed from the “rate base”, largely through borrowing by the Government’s newly-created Fair Hydro Trust (FHT).

To maintain below-cost pricing the Government must periodically instruct the FHT to borrow; in effect, the FHT issued $500 million of ratepayer obligation charge (“ROC”) bonds in February and another $400 million in April. These bonds will start to pay out in 2027, via the “Clean Energy Adjustment” line item that will be added to electricity bills in Ontario.

As planned by the Liberals, the FHP would borrow about $19 billion over 2017-2026 and pay it back, along with $21 billion in interest, over 2027-2047. I do not believe Minister Rickford will increase current below-cost prices by stopping the subsidy financing. Nor do I believe that the PCs will implement the FHP as planned by the Liberals. What are some of the possibilities? One would be for the PCs to shift the subsidy financing away from “off-book” FHT borrowing to the tax base (recall that the Liberals had created the FHT so that its borrowing would not be classified as Provincial debt.)

Why would the PCs willingly make the Province’s books look “worse”? Because the political calculus has fundamentally changed. In the lead-up to election, the Liberals needed to show the electorate, even by accounting tricks, that they were prudent fiscal managers. Post-election, the PCs have an incentive to try to show the Liberals as bad managers and indeed that they were “cooking the books.” A revised set of fiscal accounts and additional electricity subsidy financing would provide the new Government with a fiscal “crisis” that would bolster the rationale for implementing PC election campaign promised “efficiencies” and further previously-unannounced expenditure cuts that would increase income inequality.

Cancellation of Contracts

In previous blogs I’ve concluded that the main driver of Ontario’s inflated electricity cost structure has been the over-supply of regulation-exempt, long-term contracts to procure new private sector generation at above the wholesale market price (HOEP), and therefore that the review (e.g. regulation) or cancellation of some of these contracts is the single most cost-effective manner to reduce both Ontario’s current surplus electricity and its inflated cost structure.

During the election the PCs stated that they would “cancel energy contracts that are in the pre-construction phase and renegotiate other energy contracts.” Deciding which contracts to review / cancel should include a comprehensive cost-benefit analysis. Table 1 summarizes the Contract provisions related to cancellations for the feed-in tariff (FIT) and large renewable procurement (LRP) programs. FIT-2 to FIT -5 and LRP-I contracts have “pre-Notice to Proceed” (“pre-NTP”) and pre-Key Development Milestones (“pre-KDM”) provisions if the “Buyer” (the Province) unilaterally cancels the Contract at those stages. Generally, NTP and KDM are granted by the Buyer after the Contractor has obtained all necessary environmental and other approvals (after which the Contractor may commence actual construction). If cancelled by the Province ata this stage, the Buyer would have to compensate the Contractor for its “Pre-Construction Development Costs” (“PCDC”) up to a maximum defined Pre-Construction Liability Limit (“PCLL”). For example, the PCLL for a wind project is $400,000 plus $2.00/kW of Contract capacity, so that would total $436,900 for an indicative (see below) 18.45 MW wind project.

FIT-4, FIT-5 and LRP-I all have post NTP/KDM “Optional Termination” compensation provisions in the form of a formula that includes a series of components related to the costs incurred, including those related to financing, invested equity capital, but generally not including future profits. There are no equivalent “Optional Termination,” provisions for FIT-1 to FIT-3 or for Other projects for post NTP/KDM. Table 1 further shows that none of these programs include provisions related to cancellation after the start of commercial operation (“CO”).

If the Buyer were to unilaterally cancel Contracts in such cases where no compensation is specified, the Contractor would have to pursue any remedies via a generic “breach of Contract” or under the “Discriminatory Action” provisions. The Contractor would first have to engage in good faith negotiations with the Buyer, and if unsuccessful, participate in binding and final arbitration. The Arbitration Panel would presumably consider a number of factors in making its decision. One such principle would be to make the Contractor “whole” by establishing an award equal to the NPV of forecast Contract future sales minus expenses, as set out in the Discriminatory Action provisions.

FIT 2-5 and LRP-I Cancellations

The Ministerial Directive cancelled all the pre-NTP FIT-2 to FIT-5 projects, a total of 746. Based on IESO data, these totaled 268 MW of capacity, or about 41% of the total of FIT-2 to FIT-5 contracted capacity. The Directive cancelled all ten pre-KDM LRP projects, which accounted for 175 MW or 38% of total LRP-I capacity. The combined cancellation of 443 MW accounts for about 4% of all contracted renewables and about 1% of all capacity in Ontario.

Given the PC election promise and relatively modest contractually-defined cancellation compensation (PCDC), it is not surprising that these pre-NTP/KDM contracts were cancelled. The long-term public benefits from the cancellation depend on contracted price. For example, for an indicative 18.45 MW wind project with capacity factor of 35%, the cancellation of a FIT-2 contract price of $135/MWh would have a net benefit of about $114 million over 20 years (not discounted). The LRP-I prices were determined based on a competitive process and were much lower, averaging about $86 MWh, which would translate into an undiscounted net benefit of about $74 million over the same period for an equivalently-sized project.

White Pines Wind Contract Cancellation

Previously I’ve written that the Government could enact legislation to establish or unilaterally change or eliminate any compensation requirement from it unilaterally cancelling or revising a contract. This is exactly the reason the PCs cancelled the White Pines project via legislation rather than by Directive. (By way of summary background, the White Pines project Contract was awarded a FIT-1 Contract in 2010 for a 29 turbine facility near Milford. Like many other wind projects, it faced opposition from some local residents for environmental reasons and health concerns; it was also supported by others. It received a Renewable Energy Approval (REA) from the Ministry in 2015 for 27 turbines. Local residents appealed the REA to the Environmental Review Tribunal (ERT), which reduced the project to 9 turbines with a total capacity of 18.45 MW. Based on this and other approvals, IESO awarded the project its NTP in May, which allowed the Contractor, a German-owned company, to start construction, including installing some of the turbines.)

Table 1 indicates that there are no FIT-1 Contract provisions setting out the process for a pre-NTP (or NTP) cancellation. With respect to the former, it is important to highlight that in the lead-up to the October 2011 provincial election, in August that year the Liberals unilaterally offered to waive its right to cancel FIT-1 projects at pre-NTP status. Based on the likelihood that the project took advantage of this waiver option in 2011 (as most other projects did), it would not have mattered contractually that IESO issued the NTP after the elections writ was dropped – there were no pre or post NTP cancellation provisions. The White Pines cancellation legislation establishes the process and methodology to be used for compensation, similar in spirit to those used for post-NTP/KDM “Voluntary Terminations” for FIT 4-5 and LRP-I programs noted above.

The PCs did not provide a rationale for cancelling this particular project but not others via legislation. Based on IESO data, there are 336 MW of pre-NTP FIT-1 projects that could have been cancelled that would have required setting aside the granted waiver by legislation. The Government could establish the relatively inexpensive PCDC as the compensation methodology for these cases. There are about 340 MW of NTP/KDM FIT1-3 projects for which the Government could establish the White Pines methodology as a model for compensation. That is on top of the 350 MW of FIT 4-5 and LRP-I projects with NTP/KDM for which Contract cancellation provisions exist. That is a potential total of about 1 GW of additional cancellations with lower (pre-NTP) or comparable (NTP/KDM) complexity/cost than the White Pines project.

It could be the case that the Minister is testing his approach to cancellation. The general reaction amongst many financial analysts has been negative due to the likely increase in sovereign risk to Ontario from the White Pines legislation. Many legal analysts recognize that well-crafted legislation of this type would likely be successful in limiting compensation to domestic Contractors, but it is an open question whether it would stand up to the investment protection provisions included in free trade agreements, including NAFTA and the recently-implement CETA with the EU. The latter is particularly relevant because White Pines is German-owned, and the German Ambassador to Canada has publicly commented on the matter.

Concluding Thoughts

The new PC Government has moved quickly on the electricity file. It has cancelled 443 MW of pre-construction projects that would have added about 1% to Ontario’s capacity, further exacerbating the province’s surplus of expensive electricity that rate-payers would have had to pay for. Among the hundreds of other similar pre-construction/operation projects of more than 1 GW of capacity that are slated to come onstream and for which cancellation legislation would be necessary, the PCs focused their legislative power on cancelling a relatively small (18.45 MW) foreign-owned wind project. Although this was a high-profile project, it would appear to me that the PCs would not have used precious “honey-moon” legislative capital on a single project unless it also sent a very strong and clear signal to current Contractors, absent which they would not have any incentive to sit down with the Government to renegotiate operational Contracts, as the PCs have also promised to do. In a previous post I discussed the cancellation and renegotiation options and my preference that any negotiations result in the implementation of transparent rules-based economic regulation. Nothing the PCs have done so far indicates that this is their intention, unfortunately.

On the bigger dollar issue of the FHP, I expect the first indication of PC intentions will come in the fall when new subsidy financing would be required to maintain current below-cost prices. Something else to watch for are any decisions related to Ontario’s first-in-Canada low-income electricity monthly subsidy program, the OESP, introduced by the Liberals in 2016. Given recent PC decisions to reduce planned Liberal increases to social assistance rates and to eliminate the Liberal-introduced basic income pilot project, I would be concerned that the PCs may also shrink or eliminate the OESP.