What are Corporations Doing With Lender & Investor Funds?

In a previous post, I analyzed what Canadian corporations are doing with their profits. I described how across almost every sector of the economy, corporations are distributing more of their profits to owners than they are investing.

In this brief post, I’m going to describe what Canadian corporations are doing with funds acquired through issuance of debt and equity securities. I will be using StatCan data on corporate issuances of long-term debt and equity. Unfortunately, the data only goes back to 2020.

The StatCan data identifies five uses for funds:

- General corporate purposes.

- Debt repayment and refinancing.

- Working capital.

- Exploration, research & development.

- Mergers & acquisitions.

The first two uses are operational spending rather than investment. The next two could be considered investment in building tangible and intangible assets. The final one does not add any productive assets to the economy. Instead, it concentrates control over existing assets.

Since 2020, almost 75% of all funds raised have gone to general purposes and debt operations.

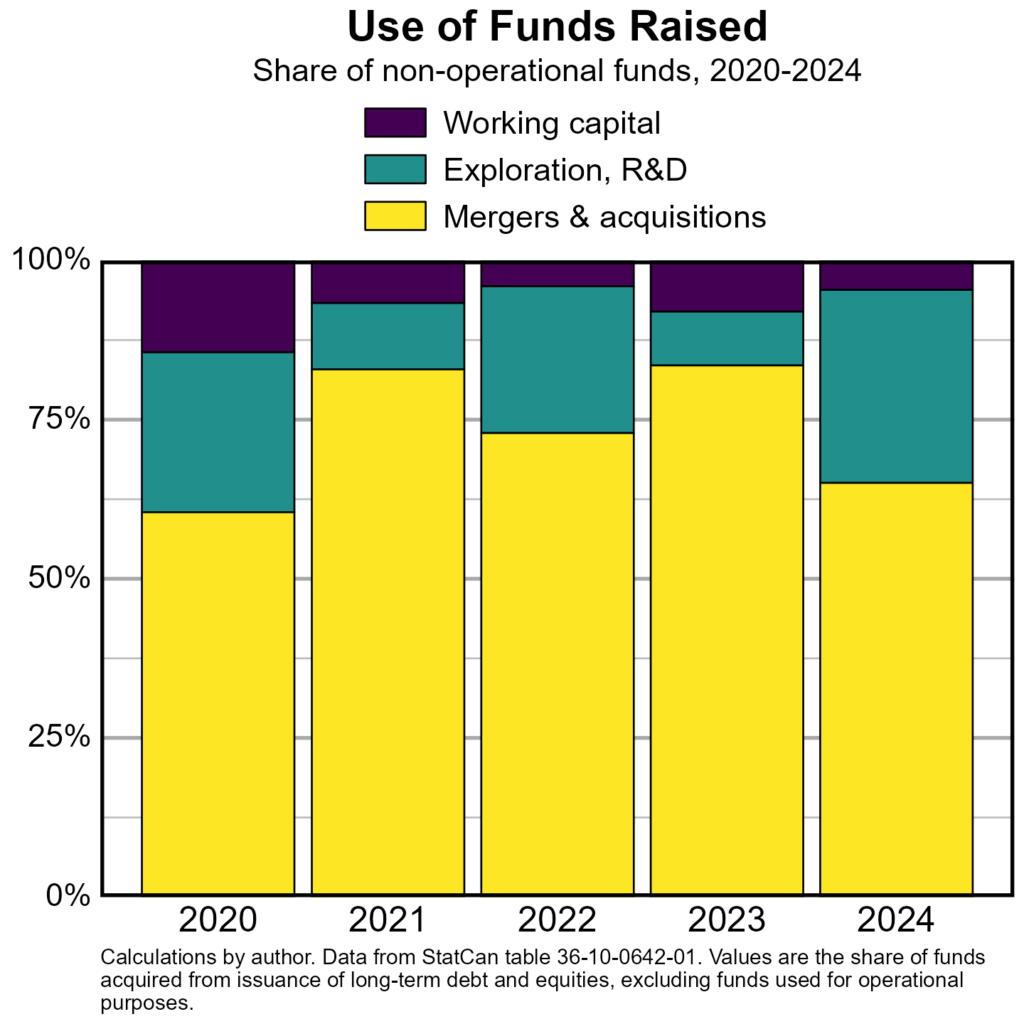

Of the remaining funds, 76% were used for mergers & acquisitions, while 16% were used for exploration, research & development, and just 8% was spent on investment in productive assets.

As seen in the chart below, the share devoted to mergers & acquisitions has fluctuated over the years for which we have data. But it has never dropped lower than 60%.

There are many reasons why companies may favour M&As over investment in new or expanded productive capacity. However, one of them is uncertainty. With mounting, intersecting crises, as well as unclear technological development in many sectors, businesses are choosing to grow via the less risky path of M&As.