Canada’s Caribbean Bank Tax Holiday

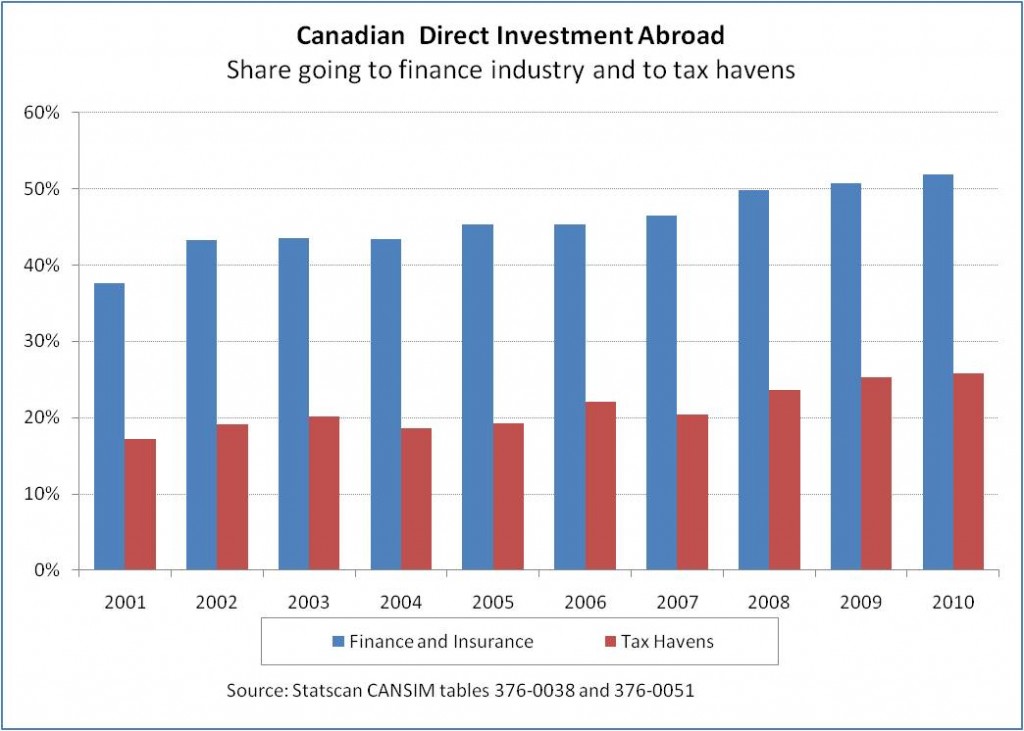

There’s a disturbing trend buried in this morning’s report by Statscan on Canada’s foreign direct investment (FDI) abroad. Not only is an increasing share of Canadian direct investment abroad going through finance and insurance industries, but a growing share is also being funnelled into tax havens.

The finance and insurance now accounts for over 52% of all Canadian direct investment abroad, a total of $319 billion in 2010, more than double what it was in 2001 when it accounted for 38% of Canadian direct investment abroad.Â

And where is this investment going? the United States and U.K. still account for the top two destinations of Canada’s direct investment abroad, 41% and 11% respectively, but their share is slipping.  Five out of the ten top destinations for Canadian direct investment abroad are tax havens: Barbados, Cayman Islands, Ireland, Bahamas and Bermuda.

Countries considered tax havens (or “Offshore Financial Centres” or OFCs) now account for 26% of all Canadian direct investment abroad: totalling close to $160 billion dollars.  That’s up from the total of $68 billion in 2001 when they accounted for 17% of Canada’s direct investment abroad and up from 22% when Statistics Canada highlighted this issue a number of years ago.  Over $110 billion or 70% of this is going to just a few Caribbean tax havens: the four listed above plus the British Virgin Islands.

What are some implications of this?

Clearly, despite all the talk from governments about clamping down on tax havens, little has been achieved, as Nicolas Shaxson demonstrates in his excellent new book, Treasure Islands.

Federal politicians have defended the weakening of Canada’s foreign investment rules by arguing that Canada’s direct investment overseas has increased more than foreign investment and takeovers in Canada. This shows that argument has no substance, particularly if such a growing share of Canada’s direct investment abroad is going to avoid Canadian taxes and financial accountability rules, a point Paul Moist raised with the House of Commons Industry Committee last month.

Finally, Canada’s banking and finance industry of course plays a large role in facilitating this tax avoidance.  While the Canadian Bankers Association emphasizes how much tax banks pay in Canada, there’s no mention of how much they avoid taxes.  Quebec economists Leo-Paul Lauzon and Marc Hasbani examined the annual reports of Canada’s big five banks a few years ago and calculated that they were able to avoid $2.4 billion in Canadian taxes in 2007 through their investments in these “Fiscal Paradises”  and almost $16 billion over the 15 years from 1993-2007.

This is an excellent post Toby. I wonder if we could interest the Auditor-General in getting onto to this again in a more serious way. Statcan should be doing a special series of studies on Canadian Financial FDI.

Keep up the good work, Toby. Good stuff.

Isn’t “Quebec economists Leo-Paul Lauzon and Marc Hasbani…,” supposed to be “…Leo-Paul Lauzon and Marc Gendron and Denis Hasbani”? I just happened to be going over articles I’ve copied and pasted, including one by Jack Mintz, whose work, in view, serves his class well, and in it he refers to the same authors and the same research. I’m guessing he’s got that reference right.

Check your google, my friend. Mintz may get paid the big bucks– but that doesn’t mean he’s correct, or even accurate with references.

And I will! Thanks! I don’t know about Mintz, but I want to get ‘my’ facts straight.