Fiscal Record of Canadian Political Parties

With all the recent news stories — as well as alarm raised by other leaders — about the fiscal and economic impact and record of NDP governments, I decided to take a look at and review the fiscal record of all federal and provincial governments in Canada for the past three decades.

These results may be surprising to some: they show that NDP governments have the best fiscal record of all political parties that have formed federal or provincial government in Canada.Â

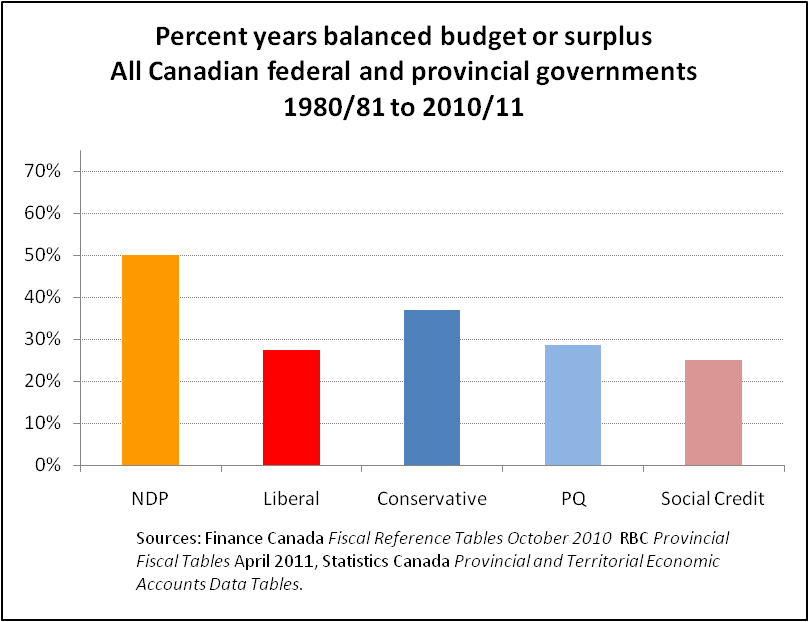

Of the 52 years the NDP has formed governments in Canada since 1980, they’ve run balanced budgets for exactly half of those years and deficits the other half. This is a better record than both the Conservatives (balanced budgets 37% of years in government) and the Liberals (only 27%), as well as both Social Credit and PQ governments. See first chart below.

It’s not just the number of years of balance that is relevant: it’s also the size of the deficits or surpluses that are important. For this, the most important figure is the size of deficits as a share of GDP.

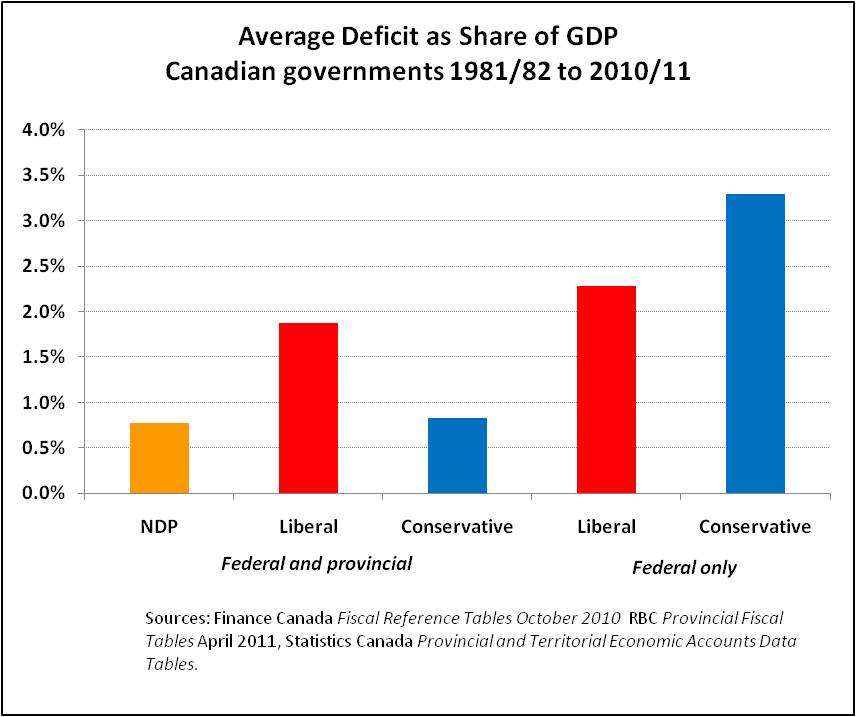

For this measure as well, NDP governments have the best record. The average balance (deficit) as a share of provincial GDP for the 52 years of NDP governments in Canada is -0.77%, compared to -1.82% for all Liberal governments and -0.82% for all Conservative governments over the past thirty years. See second chart below.  Â

The first set of figures are for all federal and provincial governments in Canada. It’s a reasonably large sample for the major parties: 157 years of Conservative governments, 106 years of Liberal governments and 52 years of NDP governments represented at one time in all different western, central and eastern regions of Canada.

The second chart with deficit shares of GDP also shows the record for federal governments in Canada over the past thirty years. And for this, it’s a different story: Conservative governments have a worse fical record than Liberal governments: they’ve been in deficit 11 out of the 14 years (or 79%) they’ve run the federal government and run deficits averaging 3.3% of the economy, compared to an average of 2.3% for the Liberals, with 8 out of 17 years running balanced budgets.Â

None of this is to argue that governments shouldn’t run deficits when it is necessary and beneficial for the economy; however, it is interesting to see that there’s no little for the fearmongering about NDP governments having a poor fiscal record.

There’s consistent public accounts data on deficits for provincial and federal governments since 1980/81 through Finance Canada’s Fiscal Reference Tables.  I’ve supplemented these with more recent figures published by RBC in their Provincial Fiscal Tables report. (The data from Statscan on provincial GDP are only available from 1981, which is why this period starts one year later). Â

Statscan also publishes data on government finances on a “national accounts” basis: the fiscal concepts are different, but the results are similar as these. I’ve left Social Credit and PQ governments out of this second chart because they are regional parties with relatively few years in government: on average their fiscal balance has been a deficit of over 1% of GDP.

Great post Toby

Seems like mr Gordon was back in the economy lab blowing up stuff again, suggesting that mr. Layton and the NDP have no clue when it comes to macro economy stuff.

I wish Gordon would get a life or at least shut the hell up. His innuendo today was totally baseless, that somehow mr Layton would be telling the bank of Canada how to coordinate policy.

Of course we all know it is but a front, and we do have to pretend, but come on gordo, do your political granstanding somewhere else would you. You are such an ego centric ot of touch economist.

Really you are, no if ands or butts. You are a just a lousy pawn, get over it.

Wow that sure pissed me off. I wish these hacks would at least wait until he got in power. And trust me gored, Layton will, and then maybe Sun TV will hire you, as that is about where you belong, if you are going to do such dirty deeds as you did today.

That should be trust me Stephen Gordon, you were up to no good today and for the record, we will ensure today’s remarks in the globe are officially remembered which seems a long way from what Toby is demonstrating here.

Good post Toby.

Despite its long standing, the “NDP = fiscal calamity” legend actually falls apart under the slightest scrutiny. Scrutiny aided by the federal government’s own data, as a matter of fact. People who loathe year-over-year deficits should move to NDP jurisdictions.

Your deficit/GDP data is a useful addition.

Cheers.

FORM FOR USE BY RIGHT-WING PARTISANS IN RESPONSE TO ARTICLE: (Please do not deviate from this form)

[Bob Rae reference]

[Derisive remark about accuracy of data and/or experimental methodology. If possible insinuate socialist inability to do math.]

[Bob Rae reference]

[Remark about Stephen Harper’s handling of the economy which is implicitly the best way to handle the economy.]

[Bob Rae reference]

[Implication that author of article is socialist, insane, whiny, lazy, and impoverished. (Note: The latter four are implicit in the socialist tag, but should be explicitly noted for other socialists who may be unaware)]

[Bob Rae reference]

[Conclusion (ie. Bob Rae reference)]

———————————————–

Doin’ my best to spread your article around. Great work, Toby. @natorierk

Excellent, thank you so much for doing the math, I am sharing this as far and wide as I can, this is important perspective for Canada and globally. The fact is, investing in people makes good economic sense.

Mr. Tulloch, I actually wouldn’t mind if the Prime Minister told the Bank of Canada how to co-ordinate policy. I’ve never quite understood why central banks are supposed to be immune from democratic control. Because our technocratic masters should never be questioned by the hoi polloi? What? It’s not like central bankers have an amazing record of doing the right thing for the economy, either.

Greens and Liberals, Harper must be stopped….This Monday May 2nd, consider lending your vote to the NDP…

For the sake of the country!

Very nice post, Toby. But how is it that the NDP appears in the table on Federal Governments?

Thanks (and long time no see!)

Rick

Regarding the NDP financial credentials,

Did you know that in 1999 in Canada if you earned $30,000 you paid a federal tax rate of 26%? Manitoba’s tax rate under the provincial conservative government was set at 48.5% of the federal rate so Manitoban’s marginal tax rate was roughly 39%. You earned $30,000 and gave 26% of that to the feds and 13% of that to the province.

For the 2010 tax year, if you earned $30,000 you paid a federal tax rate of 15% and a provincial tax rate of 10.8% for a total of 25.8% That is quite a nice change! You will notice however that most of that reduction was compliments of the fiscally conservative Paul Martin and Stephen Harper.

Rather than reduce taxes as other provinces were doing, the NDP government in Manitoba took the opportunity to increase their share from 48.5% of the federal tax rate to 70% – the highest in Canada for a modest $30,000 income – even higher than Quebec. When The federal NDP refer to the fiscal responsibility of the Manitoba NDP government they neglect to mention this. It all sounds wonderful but someone has to pay and it isn’t “the rich” or “big business”.

Left of centre politics requires high taxes to make it work. Sufficient high taxes can’t be taken from businesses because it has proven to kill jobs. The NDP in Manitoba have learned that over time. So the taxes have to come from you and I. As they age and based on their personal experience, wage earners who do not depend on the public purse for their income start moving to the right of the political spectrum. People do not avoid voting NDP because they are social irresponsible Neanderthals. It is because past experience has taught that someone has to pay and that someone is you and me.

A good start. But…

As you hinted to, annual tax revenue could be a major covariate.This could allow one party to claim the crocodile tears defense: that they had to create a budget during revenue scarcity.

What needs to be shown is that these results still hold regardless of the underling revenue. Another way to state this is that the policy behaviors implicitly measured in these graphs occur regardless of the tax revenue.

hmmm…how to tackle this? Maybe a probit model for probability of deficit as a function party and tax revenue. Could be a paper in there.

Actually this is close to work in Harpers badly mathematically garbled MA thesis; except he was looking for evidence that election cycles affect spending, but found little to support that hypothesis.

It doesn’t, Rick. The first table covers federal and provincial governments. In the second table, the NDP appears only on the “federal and provincial†side.

Got it, thanks Erin!

This data is significantly skewed given that the NDP has never been in charge of a federal budget. Health care and social security are bloated national expenditures that are not represented in a provincial budget amongst several other key sole federal expenditures. A provincial budget is much easier to balance. IMHO, A fair representation is excluding all federal budgets and doing a comparison.

Hi Bob:

You have a good point about different levels of goverment having different degrees of fiscal flexibility, but in fact the relationship is really much more lthe other way around. The federal government not only has more fiscal (and monetary) levers and so more ways to raise money and influence the economy; it also can –and has — unilaterally change federal transfers which gave a major impact on provincial revenues. It did this during the 1990s, balancing it’s budget largely on the backs of the provinces. In addition, federal changes to income tax measures can also gave a significant impact on provincial tax revenues to the extent they are on similar tax bases.

And of course, health and social expenditures are a much greater share of provincial spending than of federal spending.

So — good general point — but I think most would agree that the relationship is the other way around, with provinces more fiscally vulnerable. In fact, it is curious that provinces have a better fiscal record than the federal government given this. It may be that provinces, recognizing their vulnerability, are more cautious. I’ll also take a look at them just at the provincial level as well as you suggest.

@plg

The relationship between the two is a closed door one, that I am sure it is defined by the govt of the day, and not some arms length process which mr. Gordon went on about In his attack upon the NDP yesterday in the national media, mocking mr Layton. Funny. Really, I had thought mr grison took so much pride in his numeracy and kept to his notion that economics is a science. It sure seemed as though his political economy dimension was pretty loud yesterday.

The boc relationship is a huge mechanism that while it is perceived to be independent, as mr gordon was makingbhis case yesterday, in fact, his statement was proof that indeed the relationship is political.

purple library guy said:

“I’ve never quite understood why central banks are supposed to be immune from democratic control.”

To easy for hoi polloi to print more money or manipulate interest rates for political purposes.

>trying to keep straight face while typing<

The NDP and Liberals had some coalition governments. That is how they can be in the federal chart.

Psst, pass it on…..make sure to vote today and tell all your friends.

If just 10% more people had voted last election, Harper would never have been elected!

This is by far the most important election of our lives!

Toby: great work! But get this into a stand-alone CCPA publication, for heaven’s sake. It needs broader circulation.

Again, great job!

@chris No infact the NDP and Liberals have not had any Coalition governments and if you’d bothered to read the charts carefully you’d see they were divided between federal and provincial. But if you are referring to the 1972 , 1973 and 1974 budgets then yes the NDP did play a huge role in them but that is because they basically held Trudeau hostage by saying ” do what we say or lose power” same in the 2004 and 2005 budgets. but in both those liberal minority governments the NDP lost votes in 1974 they were reduced to 14 seats from 33. Although in 2006 the NDP gained 10 seats they acctualy lost votes in the popular vote, but their support in 2006 became more concentrated in Ontario and went down sharply in the west.

Let’s see from 2006 to 2011 we had minority government for CPC, you can’t count that as the only way to make it work is to spend on pet projects the opposition approves of, plus we had 2008 financial crisis, not CPCs fault. Now from 1984 -1992 we had PC part, lots of work to fix Trudeaus mess, and then some of there own but everyone was to chicken to cut entitlements (NDP resisted strongest). Your representation is over simplified.

Given the diversity of provincial budgets I think this is a very valid point, with the NDP and Cons deficits comparable at less than 1% and Liberal at 1.7% to be the most reflective numbers. Federally though, Mulroney inherited an intense deficit situation. The only debt he added was borrowing to pay the interest as he claims and he bit the bullet on GST while the Liberals offloaded on the provinces and grabbed 50 billion from EI, so I’d rate them even although the numbers are very different.

What a great article! Any chance you can update the numbers at end of 2013?

I have lived under NDP governments in 3 provinces. The only time they had a “balanced” budget is when they either failed to deliver promised initiatives or deferred the spending on those initiative so that they would show a false “balanced” budget.

The Federal Tories are trying that big time right now with huge promises from First Nation education to fighter jets but deferring the spending till after 2015.

In the real world those are called “deferred liailities” and have to be included in calculating what your balance book is.

Likewise in home finance, a bill which has to be paid eventually but goes unpaid for now certainly does not “balance” your budget.

The NDP have never formed a federal government, but that aside, we often see a change in government when the economy tanks for whatever reason. The good times and the bad times come and go because we really live in a world economy.

As a rule, we cannot honestly fault a government because of the economy, but there are certainly exceptions to this rule.

There are some bonehead politicians that play with our lives as they experiment on some kind of party agenda that has little or no value to the average Canadian.

But this is not the worst of the worst that we will ever experience. The worst of the worst is here on our doorstep as we see elected politicians of all stripes showing a level of entitlement that is absolutely outrageous.

This entitlement now seems to include staying in office and denying responsibility for political decisions even as criminal charges are landing all around the PMO. This entitlement includes the case of Toronto’s crack smoking mayor who refuses to do the honorable thing, or BC’s drunk driving Premiere who simply ignored having a criminal record.

In the 1990’s Glen Clark stepped aside as he was accused of personally benefiting from a contractor. This was a false media claim that didn’t stand up in court, but Clark did the honorable thing. We do not see this level of integrity with our current politicians.

I say that the outrageous attitude of entitlement our elected politicians show us is a breaking point for democracy and, of course, having honorable politicians in government at all levels.

The provincial fiscal tables you provided only start in 1996, yet the tables you give start at 1980. Also, the RBC link you provided is dead.

Could voters be more likely to elect an NDP government during affluent periods and conservatives during crises?

I would be curious to see a model where the dependant variable is the change in deficit speding as a % of GDP Y/Y, using dummy variables for the party in power and controling for exogenous economic growth (perhaps using US GDP growth, which is not the result of the ruling party’s policies).

What the Parliamentary Budget Officier had to say about Budget 2015:

Budget is now balanced but billions in future surpluses wiped out: PBO

http://ottawacitizen.com/news/politics/budget-is-now-balanced-but-billions-in-future-surpluses-wiped-out-pbo

If changes are not done to negate many of

If anything, the “facts” are largely distorted by this article. Especially with Bob Rae’s record (one of most economically disastrous tenures in Canadian provincial history) These number definitely seem more than a bit skewed and manipulated. It’s also same if you look at how much debt the NDP has left Manitoba with or BC before that. BC didn’t start to balance its budgets again until the Liberals took over.

Another thing to consider is that its easy to have balanced budgets when you raise revenue through taxes significantly, but if you spend to much (like the NDP often does) skyrocketing debts are pretty common with most NDP governments. If you were to truly examine the data objectively, I think that many things in this article would be contradicted.

How about graph comparing the governments at just the provincial levels?

One thing is important to realize about data sets such as this, is that charts showing who raised the debt by how much are skewed greatly by the fact that they neglect the effects of economic damage caused by prior governments (i.e. the massively soaring interest rates following Trudeau getting pinned on the Conservatives), and charts showing who balances the budget do not give any information on how they balanced it. Balanced budgets at a much higher tax bracket are not necessarily better for the country than slightly unbalanced budgets at a far lower tax bracket.

I’m going to second Al’s comment. You gotta compare apples to apples. I was throwing this link around until I realized it looks pretty shady to make a federal and provincial comparison when one party has never ruled at the federal level

Please clarify the line: “Of the 52 years the NDP has formed governments in Canada since 1980…” Is this a typo, or are you adding up concurrent years in different provinces?

Wow: some recent interest in this 4-yr old blog post!

I should update the figures, unless someone already has (as it was a bit of work), but given the recent fiscal performance of most governments, I’m not sure it will make a lot of difference. Maybe it will! However, there’s been more use of “rainy day funds” in different provinces by all different parties in response to mis-guided balanced budget legislation, which makes these more recent figures less reliable.

To respond to Alex, who emphasizes debt levels, the 2nd chart addressed that. The amount of debt a government leaves is effectively the cumulative deficits that they build up. And it makes most sense to present these in relative terms as a % of the GDP.

To respond to Al and Jeremy, yes, one could do comparisons just at the provincial level, but arguably federal governments have more control over their economic destiny than provinces do. They can have some impact on interest rates (well, whoever they appoint to the Bank of Canada can) and have greater control over the tax base and also spending, as they can cut transfers to download deficits onto provincial levels of government.

To Red Scourge: you’re right about having more information about how a particular government “balances the budget”. For instance the federal government just “balanced” their budget by taking billions out of the EI account, selling off GM shares at a loss, and booking imaginary savings in accounting terms for decades into the future from changes to sick leave for federal public sector workers, even though there’s no agreement on it. I don’t agree with you about lower tax rates necessarily being better though. It depends who is getting taxed and what public services those revenues support.

Finally, to Albertan1970, no that’s not a typo, and the math isn’t hard, this des add concurrent years in different provinces.

here is a comprehensive report on BC goverments debt building records. http://youtu.be/lAtAr9vnU8A

Corporate finances and public sector cash flows have different drivers and timelines as we all know. Jim Prentice seems to have found that out the hard way.

In the interests of public finance literacy, perhaps this could be re-done with “balanced budget” redefined as maintenance of a stable debt-to-GDP ratio when inflation and economic growth are taken into account. Otherwise we’re taking austerity as the balance point, non?

It would be nice to see the correlation between the years NDP ran “balanced” budgets and the years they introduced tax hikes. My gut feel is that there is a direct relationship. So, it is not the NDP who balanced the budgets, but the general population. Communism has never worked anywhere. What makes you think it will work in Canada?

Toby, your replies to people’s comments clarify your biased position when conducting your work. If you already have the data, surely it would be easy work to display the results of a provincial-only comparison; a few clicks in Excel pivot tables, really. Yet you instead make excuses that it’s the federal ones that matter, despite the fact that there has been no federal NDP government to compare to. So you make a showing of how NDP governments are the most fiscally responsible, but shoot yourself in the foot by saying provincial governments have less control over their economic destiny than federal (your words, not mine). So basically the NDP governments owe their success to the federal PC and Liberal governments? Just bite the bullet and show Provincial-only comparisons, even though it doesn’t agree with your NDP bias. Otherwise, your entire article is basically a waste of time if you don’t represent the data fairly and objectively.

Hey Toby,

I was interested in recreating your dataset to look at a few other things (e.g. other distributional moments, and maybe a few basic macro-model analyses), but your links don’t have the data I’m looking for (the Fiscal tables only run back to ’96, and the RBC link is dead; I think this has data, though: http://www.rbc.com/economics/economic-reports/pdf/provincial-forecasts/prov_fiscal.pdf).

Do you have your dataset still? Would you be willing to share it?

Thanks,

Justin

Why aren’t the ndp and social credit parties lumped together like the PC and conservatives…

Just commenting that if ‘Liberal’ here includes the provincial BC Liberals since 2001 then that misnomer’s stats belong in the ‘Conservative’ column; the alienation and distancing between the federal and provincial Liberals in BC may be lessening but they are not the same party nor the same ideology; the BC Liberals provincially have been Reform/Tory federally….. no real relation to the historical Liberals of Boss Johnson and Duff Pattullo

In response to some more recent comments:

1. The results at a provincial level are fairly similar to those combined provincial/federal. Tony Nickonchuk did a more extensive and more up-to-date analysis at the provincial level that he published with posts at his blog:

http://cloudywithachanceoffacts.squarespace.com/blog/2015/5/3/dont-fear-the-dipper-part-1

http://cloudywithachanceoffacts.squarespace.com/blog/2015/5/4/dont-fear-the-dipper-part-2

2. I’m updating and extending my data (which wasn’t in a presentable form) and will publish something more extensive on this soon, making the dataset available.

Why not combine NDP and Social Credit in BC? Perhaps because they are completely different and competing parties…

It is true that there should be many caveats with these types of comparisons, including economic circumstances, impacts of upper levels of government and previous governments, etc….

This data is not really useful, unless you give some dates to go with it. If many of the NDP governments were during times of global economic prosperity, for example, this would point to a completely different reason for lack of deficits.

If I borrow your car and drive it around putting next to no gas into it and then hand it back to you when the tank is empty then my gas expenses will be quite low and your gas expenses will be quite high. To then say that I am better at saving money than you would simply be weak logic.

Thank you for this information. More people should read it!

Any chance you could do an updated version of this? Asking for a province.

Nailed it. The sarcasm is beautiful.